air freight rates fell sharply at the end of 2025 after the traditional peak shipping season, despite a year marked by geopolitical tension, shifting supply chains and trade disruption.

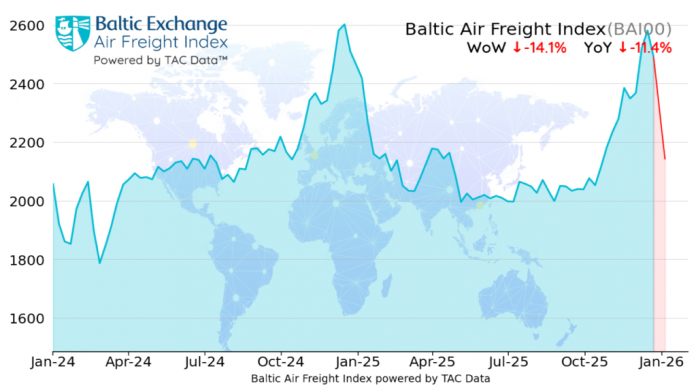

Data from the Baltic Air Freight Index (BAI), compiled by TAC Data, shows that global air cargo rates followed a familiar seasonal pattern.

Prices rose steadily ahead of Thanksgiving in the United States and Christmas in Europe, before dropping sharply as demand eased over the New Year period.

The global index fell by 15% in the four weeks to 5 January, leaving rates 11.4% lower than a year earlier. Much of the decline came in the final week of December, when rates dropped more steeply than usual.

Analysts said it was notable how closely air cargo activity tracked previous years, despite major uncertainty around tariffs, geopolitics and supply chains.

While direct trade volumes between China and the US declined during 2025, this was offset by growth on other routes, including China–Europe, intra-Asia, and services into the Middle East and Africa. The shift highlighted the flexibility of the air cargo sector, which was able to redeploy capacity quickly as demand changed.

Early in the year, cargo volumes were boosted as shippers rushed to move goods ahead of threatened US tariff increases following the re-election of President Donald Trump. After volumes briefly fell when tariffs were announced, demand rebounded when some measures were eased, prompting companies to restock.

Supply chains also continued to evolve, with many manufacturers adopting “China plus one” strategies, driving growth in intra-Asian trade. E-commerce flows shifted towards Europe, the Middle East and Africa following changes to US rules on small parcel imports.

Despite rising cargo volumes, air freight capacity remained tight. Aircraft delivery delays at Airbus and Boeing continued, while shortages of suitable aircraft for freighter conversion limited supply. Capacity was further reduced late in the year after a fatal crash led to safety checks grounding parts of the global MD-11 freighter fleet.

Lower jet fuel prices, down around 4% on average over the year, helped support airline profitability.

However, spot rates dropped sharply after Christmas. Prices from Hong Kong to the US East Coast fell from HK$54 per kilo at the start of December to HK$43 by early January. Similar declines were seen on routes to the US West Coast and Europe.

Rates from other Asian markets, including Vietnam, South Korea and India, also eased towards year-end. Taiwan stood out as an exception, with rates remaining higher year on year, driven by strong demand for semiconductor exports.

In Europe, outbound rates held up better in December but remained well below last year’s peak levels. US export rates also fell sharply, ending the year significantly lower than in 2024.

Looking ahead, industry participants remain cautiously optimistic, with expectations of a short-term rise in demand ahead of the Lunar New Year, supported by continued strength in semiconductor shipments.