Global air cargo volumes rose 4 percent year-on-year in April, but with the removal of the de minimis threshold for shipments from China to the United States taking effect today, industry analysts at Xeneta warn of a looming disruption. With macroeconomic uncertainty hanging over the market, the key question for 2025 is no longer whether the market will soften, but how severe the impact will be.

For the past decade, US consumers enjoyed duty-free treatment on shipments valued at 800 dollars or less, helping fuel a boom in cross-border e-commerce. As a result, package volumes surged to approximately 1.35 billion annually. However, as of May 2, low-value goods from China and Hong Kong are now subject to a 145 percent tariff, while postal service imports face either a 120 percent duty or a flat fee of 100 dollars, which will rise to 200 dollars on June 1.

With e-commerce representing around 50 percent of all air cargo shipments between China and the US—roughly 6 percent of global air cargo volume—the expected drop in demand is already affecting capacity planning. Freighter flight cancellations and rerouted trade lanes are among the early signs of turbulence.

Temu, one of China’s largest e-commerce platforms, has responded by slashing its advertising budget in the US. Niall van de Wouw, Chief Airfreight Officer at Xeneta, says the effects of these changes will ripple far beyond the US.

“This is a double-edged sword. A decline in demand on one of the most important airfreight lanes between Asia Pacific and North America will have a major impact. But the global redeployment of capacity will also be a significant factor,” he said.

“This may be the year when we grow tired of reading the word ‘unprecedented’ in market updates. The future of the market will depend on the duration and outcome of this uncertainty, and right now the outlook is concerning.

“This is not limited to one sector. Entire trade corridors are being affected in ways we have never seen before.”

April Slowdown Mirrors Growing Fragility

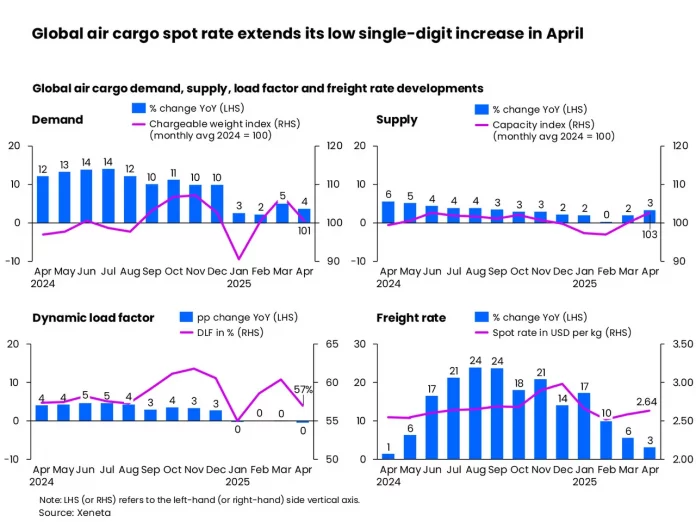

Despite a 4 percent volume increase in April, global air cargo spot rates grew just 3 percent year-on-year, reflecting a slowdown in demand. Jet fuel prices dropped 24 percent year-on-year during the first three weeks of the month, adding downward pressure on rates.

Available capacity in April rose 3 percent compared to the previous year, but the dynamic load factor—a measure of cargo space utilization based on volume and weight—dropped by three percentage points to 57 percent.

In early April, the implementation of new US tariffs triggered a surge in air cargo from Asia to North America, as shippers scrambled to get goods in ahead of the changes. This rush caused spot rates to spike by 13 percent from Southeast Asia and 10 percent from Northeast Asia. However, those gains reversed in the latter half of April after a 90-day tariff pause was announced alongside 145 percent retaliatory tariffs on Chinese goods.

The North America to Northeast Asia corridor saw the sharpest monthly increase in rates, up 14 percent, driven by exporters rushing goods to China and Hong Kong amid concerns of reciprocal trade measures.

Elsewhere, spot rates between the Middle East and Central Asia to Europe remained flat compared to March but fell 26 percent year-on-year. This decline reflects easing supply pressures after Red Sea disruptions. On transatlantic routes, rates fell 7 percent from March, impacted by increased bellyhold capacity from seasonal flight additions and holiday slowdowns.

On the Northeast Asia to Europe route, outbound rates rose slightly month-on-month and were up 10 percent year-on-year. In contrast, backhaul rates to Northeast Asia dropped 17 percent, underlining persistent trade imbalances.

Uncertainty Clouds Forecasts

Van de Wouw said April’s figures offered little clarity about the full-year outlook because the impact of the new tariffs had not yet fully materialized.

“The global air cargo market is in a holding pattern. It’s extremely difficult for businesses to shift sourcing strategies quickly enough to avoid these tariffs. They are looking for ways to mitigate the impact, but the true scale is still unknown. The big question for everyone is: what kind of year will this turn out to be?

“The changes to de minimis rules in the US are going to cause significant disruption, and that will become more evident in May’s numbers. A logistical mess is very likely.”

Van de Wouw also noted that many US consumers were likely unaware of the previous de minimis rule—and are now facing higher costs. He shared an example from a US logistics consultant who reported that a 19.49 dollar surge protector from China cost 48.38 dollars in a Temu cart once taxes and shipping were applied. The consultant’s message: the days of free shipping from China are over.

Air cargo demand grew by double digits in 2024, with forecasts for 2025 initially projecting 4 to 6 percent growth. Van de Wouw now says any attempts to revise those predictions would be “meaningless” under current conditions.

Tariff Burden Could Override Rate Relief

“Lower airfreight rates may benefit shippers and forwarders, but if tariffs prevent goods from being sold, that’s bad for the economy and the need for airfreight,” he said.

“For most airfreight shipments, cheaper rates will not make up for the higher cost of duties.”

Whether the tariffs will remain in place long-term remains uncertain.

Eyes on E-Commerce as the Storm Builds

“This feels like the calm before the storm,” van de Wouw added. “If the new de minimis system stays in place—and given the reported investment by US authorities, there is little reason to expect otherwise—airfreight volumes from China to the US will undoubtedly suffer.”

The broader airfreight market cannot absorb the shortfall in e-commerce volumes, he warned. However, airlines may adapt their networks to redirect capacity to other regions, which could benefit global shippers.

“But even if capacity becomes more available elsewhere, shippers will still need viable trading environments to take advantage of that opportunity.”